WHAT IS FOREX

THE FOREX MARKET

The stock market is a place where traders gather in order to buy and sell some product, with the intention of benefiting from the price differences, like the gold stock market, silver stock market, oil stock market, etc.

The global currency exchange is one of these said stock markets, where different currencies are bought and sold, with the intention of benefiting from the currency prices differences.

The global currency exchange is called the foreign exchange, which is known as Forex (FX), and is also known as the currency market. This name has historical origins. After World War II, the Bretton agreement was signed in 1947, which included currency assessment by comparing the Dollar, instead of gold. There was stability in the rates between currencies before 1947, and therefore, currency trading was not possible, due to the absence of noteworthy fluctuations. In 1947, U.S president Richard Nixon decided to untie the connection between the Dollar and other currencies. Since then, prosperity of the market was created due to fluctuations in currency values. However, it was limited to the biggest banks and investment houses, because of the huge amounts needed for trading to benefit from this fluctuation.

Since the beginning of the internet revolution in the mid nineties, and the development of the leverage and the margin, the currency market has expanded and became available even for small traders.

The size of the Forex currency market is currently considered among the biggest in the world, where the rate of trading reaches around three trillion dollars daily.

Advantages of the Forex market

* The Forex market is characterized by features such around the clock activity: The activity in the currency market is continuous for 24 hours, five days a week. Saturdays and Sundays are days off.

* High liquidity: The currency market is the biggest trading market in the world, with a trading volume of two thousand billion dollars daily, which means the presence of buyers and sellers is around the clock.

* Fairness and transparency of the market: The immense nature of the currency market, and the fact that it is affected only by the official data regarding the biggest countries in the world economically, and the officials of these countries, makes the currency market the most transparent. There are no secrets or manipulation here.

* Benefitting from the rises and falls of the market: Since currency trading is based on pairs, if the rate of one currency increases, the rate of the other currency decreases against it, generating balance.

* Clarity and limitedness of the market: The number of currencies being traded is very limited, this leads to the concentration on the direction of the rates, and makes it easier to keep track of news.

* Leverage: the currency market is where the highest leverage exists.

* Leverage: the currency market is where the highest leverage exists.

* The main currencies: Each country has its own currency, and it is given a special symbol in the global market. This symbol consists of three letters, the first two for the global symbol of the country, and the last one for the currency.

* Currency pairs: Trading in the Forex currency market is based on currency pairs as EUR/USD, where buying and selling processes are executed by buying one of this pair, and selling the other against it. The international banks have agreed upon arranging the currencies symbols in all pairs, in order to unify trading between them. The currency symbol on the first on the left is called the Base currency, and the currency symbol on the right is called the Quote currency, where the price is the paid amount required to get one unit of the Base current.

So, when we say GBP/USD, the British pound is put first, so it is the Base currency, and that means that the price in the formula is the price required to be paid by the second currency (the American Dollar) to get one unit of the Base currency (one British pound).

FOREX TRADING STRATEGIES

There are many things to consider when trading forex. These choices become even more important for many individual traders because they aren’t trading forex for a living, but are rather part-time traders, with other jobs and commitments. This can make things extremely difficult in a fast moving market like the currency markets, but there are some strategies you can follow to help you have a better chance at success when trading forex, even if you’re a part-time trader.

Choose a time frame to trade and focus on the most active currency pairs during that time frame. If you’re trading full time it makes sense to trade during the U.S. session, because most USD currency pairs will be most active during this time. Many traders won’t have this luxury however, so they need to make a plan that takes into account what currencies are most active during the times that they are trading. Those in the U.S. who trade in the evenings may want to focus on AUD pairs. If you’re trading later in the night (after 9pm EST or 2am GMT) you can also look at other Asian currency pairs such as the Japanese Yen, Hong Kong dollar and Singapore dollar. If you’re a morning person and want to trade at say 4am or 5am EST your best bet is to look into the Euro and Great Britain’s Pound. The point is, no matter when you choose to trade, your best strategy is to focus on the most active currencies during that time frame.

Advantages of the Forex market

Consider trading longer time frames. Some forex traders focus exclusively on daily and weekly charts and place trades that can last for days and weeks as well. They claim that the market is more predictable when trading these longer time frames. If you’re a part-time trader this may be a good strategy for you to use since you can’t always have your eye on the markets. Even if you’re trading full-time you may want to use this strategy as it gives you the chance to analyze the markets more completely before making a trade. It may not sound as exciting as the fast-paced world of day trading, but it can be just as successful in the long run.

Always have a plan when trading. This is a strategy that applies to everyone. It doesn’t matter if you’re a new or experienced trader, if you’re trading short or long time frames, or if you’re trading based on technical or fundamental analysis. You will always need a plan that includes an entry and exit point, what direction you’ll trade, why you believe the market will move in the direction you choose, and a stop loss level that will take you out of the trade if it doesn’t go as planned. This single strategy should be the backbone of your trading throughout your career.

By using strategies that increase the chance of success and decrease the chance of failure you can survive in the market long enough to gain the experience necessary to become a successful full-time trader. Even when following these strategies you’ll find that the forex markets are risky however, so always be prepared for losses, and have a strategy to deal with those as well as the hope for succesful trades.

CFD GLOSSARY

Here we have compiled a list of commonly used terms in Forex and CFDs of Forex trading

Leverage:

Leverage increases your purchasing power hence enables you to gain a large exposure to a financial market while only tying up a relatively small amount of your capital. CFDs are leveraged, which means you only have to put down a small deposit for much larger exposure. Leverage increases your profit potential and the risk of losing your capital. Our CFDs have a static leverage that depends on the Asset you’re trading.

Margin:

When trading CFDs on leverage, you must maintain a certain level of funds in your account (the necessary margin), also known as a good faith deposit. Calculating and understanding your necessary margin requirements beforehand allows you to apply good risk management and avoid any unnecessary margin calls resulting in the closing of a position due to not enough margin in your account.

Margin Call:

Margin Call refers to the situation where the broker ask for additional funds to cover losses from your lose making positions. Failure to meet margin calls will lead to automatic closing of your positions. There are no margin calls when trading CFDs with us but your position will automatically be closed when price reached the stop loss level.

Is Leveraged Trading Risky?

Even though you only put up a relatively small amount of capital to open a position (initial margin), your profit or loss is based on the full value of the position (Invested Amount * Leverage). So the amount you gain or lose might seem very high in relation to the sum you’ve invested. However, it should always be kept in mind that leverage not only magnifies your potential profits but also your potential losses. Additional information about the maximum loss or gain from each position can be found below.

Trading Profit and Loss Calculation:

Pip value: is an important component of the P&L calculation and will be given to you by the platform prior to opening your position.

Formulas:

Pip value for Forex (other than JPY) = (invested amount * Leverage) / open price / 10,000

Pip value for Forex where JPY is the quoted currency = (invested amount * Leverage) / open price / 10,000

Pip value for Equities and Commodities = (invested amount * Leverage) / open price / 100 Note that the pip value given by the platform is the base currency of your account. Profit and Loss Formula = (pips movement * pip value) – swap charges

Pending Orders:

You can set pending/future orders for entering into a position when the actual price will reach your target/set price.

Buy Limit:

An order to buy at a specific price that is lower than the current one.

Sell Limit:

An order to sell at a specific price that is higher than the current one. Note that there are restrictions of how close your pending order price could be from the current price

Take Profit:

Take profit is a pending order at a predetermined price to exit a profit making position. You can set or change your take profit price (or amount) at the start or/and during the period of your position. We recommend to check the take profit price prior to opening a position. Note that there is a limit on the range between the open price and the take profit price.

Example: You open a SELL position on EURUSD at 1.1208 with an invested amount of 100 EUR. The pip value will be 3.5688 EUR and the take profit will automatically be set at 1.118 so if the price reached the take profit you will win 100 EUR (3.5688 * 28pips ≈ 100 EUR). If you wish to decrease the take profit level further at 1.11 then the potential gain of your position will increase to (3.5688 * 108) 385.4 EUR.

Stop loss:

is a pending order at a predetermined price to exit a loss making position. You can set or change your take stop loss price (or amount) at the start or/and during the period of your position. We recommend to check the stop loss price prior to opening a position. If you change the initial stop loss level your invested amount (margin) will change also but the pip value will remain the same. Note that there is a limit on the range between the open price and the stop loss price.

Example:

You open a SELL position on EURUSD at 1.1208 with an invested amount of 100 EUR. The pip value will be 3.5688 EUR and the stop loss will automatically be set at 1.1236 so if the price reached the stop loss you will only lose your invested amount (3.5688 * 28pips ≈ 100 EUR). If you wish to increase the stop loss further at 1.1250 then the risk of your position will increase to (3.5688 * 42) 150 EUR meaning that your invested amount (margin) will automatically go to 150 EUR.Trading Costs:

Spread: is the difference between the bid (sell) and ask (buy) price. The difference is presented in pips and reflects the cost of opening a position. The related cost will be spread * pip value.

Swap: Swap is the interest deducted from the Profit/Loss of your position and is only charged when a position is held open overnight. Swap charge formula: Invested amount * Leverage * swap rate / 365days.

Why Invest With Us

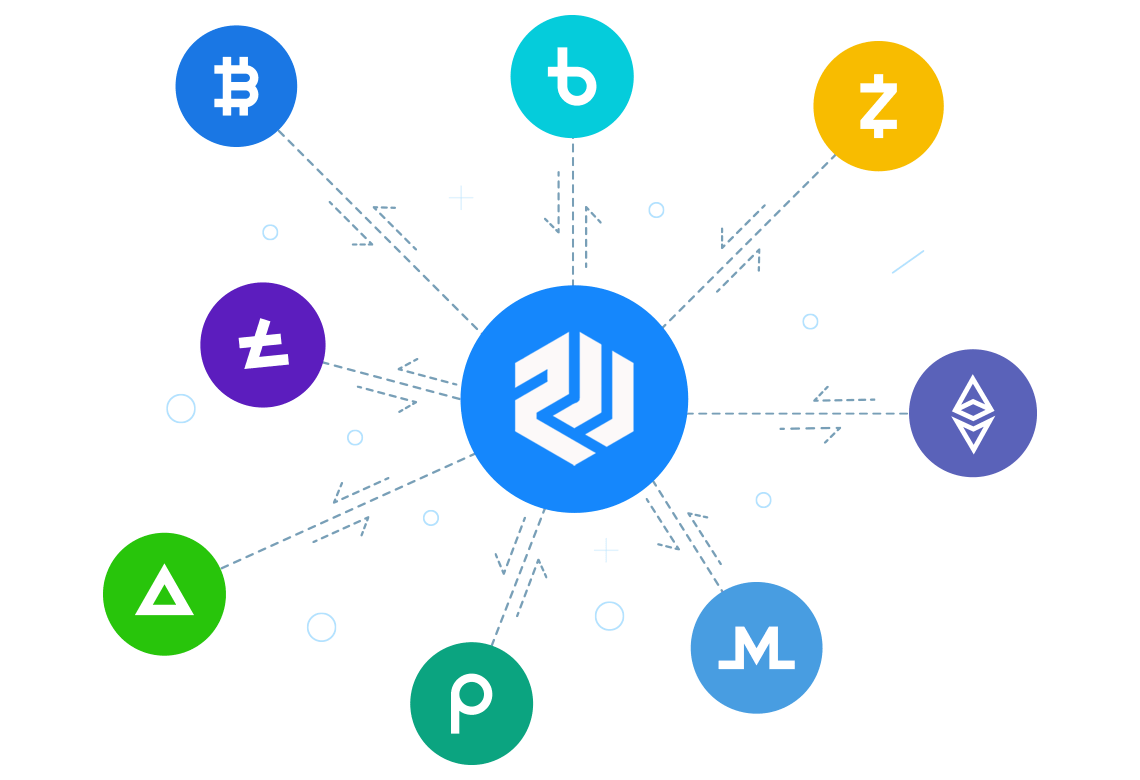

Making life easy for our investors, we embedded in our platform the option to invest with multiple digital currencies – with zero fees.

-

Licensed Script

Blockztrade Investment do legal and licensed business. So we do use licensed and valid script which is fully secured from any fraudulant activities.

-

Secured Enivronment

Website of Blockztrade Investment is completely secured and assured by Comodo EV SSL and DDos protected servers.

-

Instant & Automatic Withdrawal

System properly optimized for automatic withdrawal system which means every transaction will be done instantly.